Wealth Management News & Updates

How Amazon Employees Can Maximize Their 401(k) with the Mega Backdoor Roth Strategy

Amazon’s 401(k) plan offers a powerful but often overlooked opportunity for high-income employees: the Mega Backdoor Roth. By combining after-tax contributions with in-plan Roth conversions through Fidelity, eligible Amazon employees can contribute far beyond standard Roth limits and build significant tax-free retirement wealth. This guide explains how the Amazon 401(k) works, current contribution limits, SECURE 2.0 implications, and key planning considerations to help Amazon professionals maximize long-term tax efficiency.

TRICARE for Life Planning for Women Military Retirees and Business Owners

For women military retirees—especially those who own businesses—TRICARE For Life is one of the most valuable benefits earned through service, but only if it’s planned for correctly. This guide explores how Medicare rules, income planning, and business decisions made in your 50s and early 60s can affect healthcare costs, coverage, and flexibility after age 65. Early, informed planning can turn TRICARE For Life into a cornerstone of long-term financial security.

Understanding the Costs and Tax Implications of Holding Precious Metals

Be tax savvy and don’t get surprised by the hidden costs and tax implications of holding, buying and selling precious metals.

Financial Planning for Women Entrepreneurs: Building, Growing, and Exiting a Successful Business

Explore financial planning strategies for women entrepreneurs across every stage of business: launch, growth, and exit. Learn how to turn your women-owned business into lasting wealth.

Empowered and Informed: Questions Every Woman Should Ask Her Financial Advisor

Discover the top 10 questions wealthy women should ask a financial advisor after divorce or widowhood. Build confidence and a legacy on your terms.

2025 Retirement Savings Contribution Limit

Are you on track with your retirement contributions? The IRS has increased retirement plan contribution limits for 2025, offering new opportunities to maximize tax-advantaged retirement savings.

Digital Estate Planning: How to Protect and Pass On Your Digital Assets

Learn how to protect and pass on your digital assets with a comprehensive digital estate plan. Explore key steps, legal considerations, and expert tips for managing your digital legacy.

Owning Your Financial Power After 50: A Legacy Built on Your Time

Are you a woman navigating life after divorce, widowhood, or years of putting others first? You’re not alone and you’re more ready than you think. Whether you’ve inherited assets, managed a household, or are holding a portfolio you didn’t build, now is your time to take the lead.

It’s never too late to step into your financial life with clarity and confidence. Start by understanding what you own, how your money flows, and whether your investments reflect your goals and values. Your wealth should reflect you. Let’s build a financial plan that empowers you to lead with confidence and live with intention.

5 Things To Know If You’re Considering Early Retirement

Retiring early is an appealing goal, but it comes with complex emotional and financial decisions that go far beyond simply having enough savings. Before making the leap, it’s essential to reflect on your motivations and readiness for the dramatic lifestyle shift. Will you miss the structure of work? How will you stay socially connected or find purpose day to day? Understanding your personal reasons and preparing for the mental and emotional transition is just as important as crunching the numbers. A realistic retirement budget—factoring in your essential expenses, lifestyle goals, and unexpected costs—is the foundation for deciding if early retirement is truly within reach.

Beyond budgeting, early retirees must plan for the financial trade-offs of leaving the workforce sooner. This includes the long-term impact on Social Security benefits, accessing retirement accounts without penalties, and bridging the health insurance gap before Medicare eligibility at 65. Timing is everything—decisions like when to claim Social Security and how to draw down your savings can significantly affect your tax situation and long-term income. The blog also explores practical strategies to move your retirement timeline up, such as working a few more years, paying off debt faster, or optimizing your investment and tax planning. With careful preparation, early retirement can be more than a dream—it can be a well-executed plan.

Estate Planning: The Essential Instruments

Estate planning isn’t just for the wealthy or elderly—it’s for everyone who wants a say in what happens to their health, family, and finances. This post breaks down the 3 essential documents every adult should have: a will, a health care proxy, and a durable power of attorney. Protect your wishes and the people you love.

Is Your 401(k) Savings On Track?

Your retirement savings journey doesn't have to be a mystery. Whether you’re just starting your career, in your peak earning years, or approaching retirement, your 401(k) should evolve with you. But how do you know if you’re on track?

This blog breaks down what "on track" looks like at every stage—offering age-based savings benchmarks, asset allocation strategies, and practical tips like how to make the most of employer matching and catch-up contributions. From maximizing growth early to reducing risk later, we help you understand how to keep your retirement goals within reach—no matter where you are in your career.

Start building your roadmap to a confident retirement today.

The Million Dollar TSP

Are you approaching or reached a million dollars in your employer retirement account? Congratulations! More than likely, your retirement goal is now funded. If the entire account is allocated to pretax retirement savings, it’s time to speak with an advisor to do some tax planning. There are several strategies that can be utilized to reduce the income taxes you will pay over your lifetime.

Is Your Business Thriving? Explore Beyond the 401(k) to Save on Taxes and Build Your Dream Retirement.

Consider looking beyond the 401(k). Our latest post explores the cash balance plan as a powerful tool to realize your retirement dream.

Overwhelmed by Retirement Plan Choices for Your Business?

Wondering which retirement plan works best for your business? Clear Insight can help business owners navigate retirement plan choices and save money on taxes.

OPM Announces Suspension of FLTCIP to Continue Through 2026

If you’ve been waiting for the Federal Long Term Care Insurance Program to re-open to new enrollees, it looks like you will have to wait two more years. The Office of Personnel Management (OPM) announced on November 13, 2024, that the program suspension will be extended through December 2026.

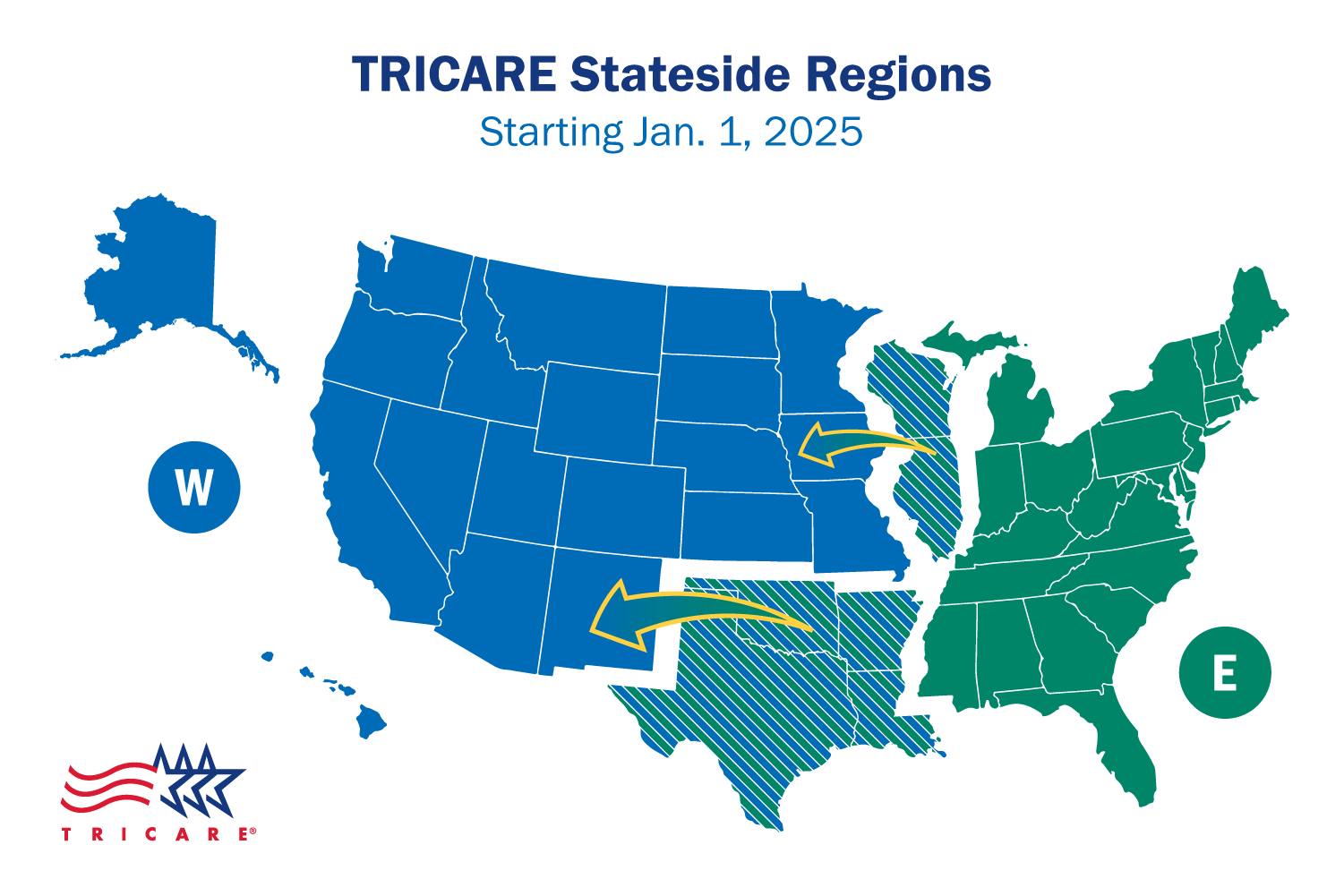

It’s Open Season: Active Duty, Guard and Reserves and Retiree TRICARE, FEDVIP, and other benefits updates are here!

From November 11 through December 10, you have a chance to choose the TRICARE plan, dental and vision coverage that best works for you and your family. There are several changes that service members and retirees should be aware of, not least of which are rate hikes across the plan.

2024 FEHB Open Enrollment Season: What Federal Employees Need to Know

The 2024 FEHB Open Enrollment Season is here. It is time to comb through the fine print because there are some big changes.

How Federal Employees Can Plan to Retire on Time

Federal employees, retiring on time is possible with the right plan in place. Read our insights to prepare for a smooth transition.

7 Key Components of Retirement Planning for Business Owners

Planning for retirement as a business owner is unique. Discover 7 essential components you need to pursue a solid financial future—and how we can help!

What Is Your Long-Term Care Plan?

Have you thought about your long-term care plan? Don’t wait until it’s too late—read our latest article to prepare for your future today.